The good and bad of low commodity and oil…

The recent market turmoil has led to continued drops in commodity prices including oil and most metals. Lower prices and high price volatility is putting pressure on companies in the resource sector. In general, renewable energy companies have also been affected as the market seems to believe that lower oil prices will either indirectly lead to lower power prices or at least signal that power prices may come under pressure from some of the same factors impacting oil.

For renewable microgrids, the impact of lower fuel and commodity prices can be even more severe – the primary application of renewable microgrids is typically diesel displacement, and many of the commercial users and communities in remote areas where diesel is the primary power source are heavy dependent on the resource industry. However, there are some positive aspects the commodity bear market that should also be considered. Looking at both sides –

Good

- Potential clients in resource industries are more cost conscious and open to alternatives that will provide value.

- Volatility in fuel prices makes planning difficult and therefore stable alternatives such as renewables can be preferable.

- End-users may be able to push for better pricing due to lower diesel costs and lock in favorable contracts.

- Fuel subsidies in emerging markets are being reduced or eliminated in many markets (as has been happening since the beginning of 2015).

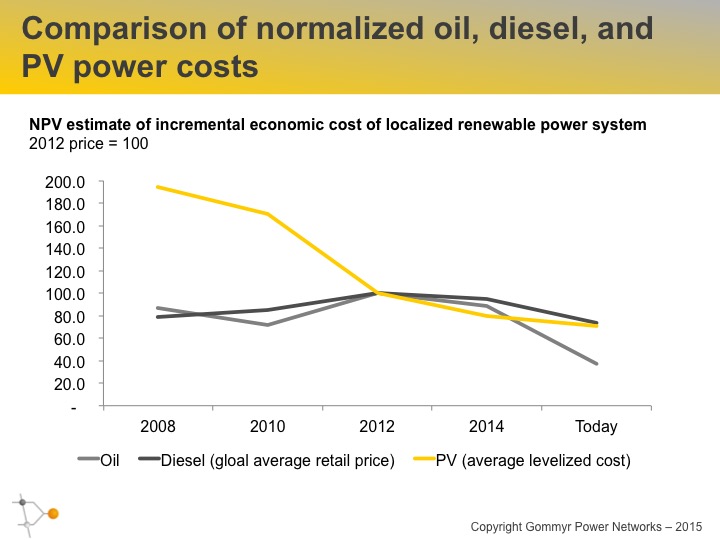

- Much of the oil cost reduction is not passed on to end-customers as refiners, distributors, retailers and governments take a bigger share – angering end-users and making them open to alternatives (see chart).

- Renewable and storage technology costs are also dropping and some commodity price reductions will feed through to the end prices of these technologies.

Bad

- Diesel users are paying lower energy costs and therefore require even lower pricing to consider alternatives.

- End-users in the resources sector may be considered less credit worthy making project bankability an issue.

- Potential clients in the resource sector may have more critical issues to deal with.

- Decisions are often not made or delayed in times of uncertainty.

- Cashflow and investment from resource industry clients will be significantly reduced.

Overall, the recent turmoil and low commodity prices will likely slow growth in renewable microgrids in the short term. This commodity downturn will force renewable project developers and suppliers to be more competitive, focus on stronger projects and offer clear value propositions that will mean a stronger basis for future growth and even greater benefits when oil and commodity prices do rebound.