Race to the Bottom – How Renewable Microgrids will…

The fall in oil prices has created a number of knock-on effects for renewable energy and other emerging clean technologies. Some of these effects are clear cut; for example lower gas prices makes the economic case for electric vehicles more difficult. Other impacts are less clear-cut; for example how potentially lower electric vehicle sales will change the future technology development and price reductions of lithium ion battery storage. The business case for renewable microgrids is impacted by both these direct and indirect effects.

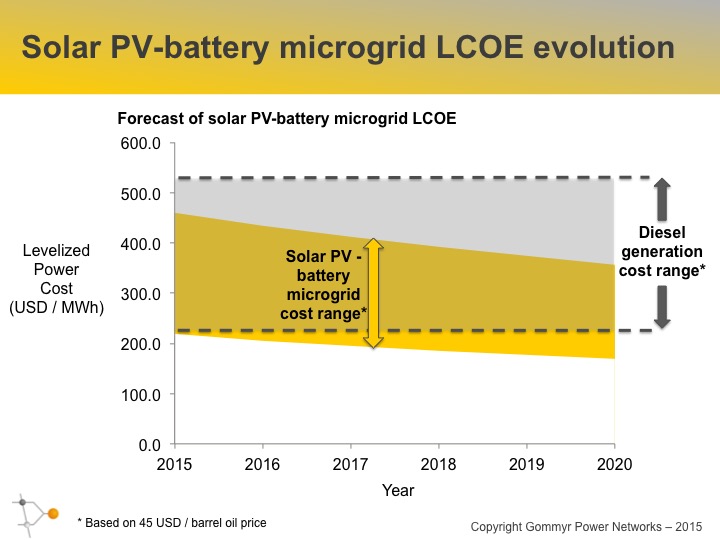

The clearest business application for renewable microgrids is to displace expensive diesel generation, however, microgrid projects can be delayed or cancelled if the economics no longer support the investment in the current environment. With oil in a 45-55 USD range, the underlying cost of diesel will be 0.75 – 0.95 USD / litre in well-connected and accessible areas; with costs increasing up to 1.40 – 1.50 UDS / litre in regions with difficult access (and possibly much more in very remote areas). The cost of diesel generated power will be between 220 – 520 USD / MWh within this range.

As can be seen from the LCOE forecast, microgrids based on solar PV and batteries are still competitive at current oil prices. More significantly, due to annual cost reductions of approximately 5%, such microgrids will be increasingly competitive over the coming years.

There are some further interesting aspects to the current situation – Firstly, in the current low oil price environment, only the best microgrid projects (e.g. those with high diesel costs, good irradiation, and favourable load profiles) will be sufficiently competitive to receive investment. Developers, suppliers, and investors should identify and focus on such projects for the sector to continue its strong growth.

Secondly, renewable microgrids will be increasing competitive even if oil drops further in the future, as there will be a diminishing impact from future price drops. At 50 USD oil, the oil component of the end user diesel cost is less than 50% (without considering taxes or subsidies). In countries with high diesel taxes the oil component is even less and can account for less than 30% of the end-user cost. This means that a 20% drop in the oil price will impact the end-user price by less than 10%. This effect increases as the oil price drops and the fixed costs of refining, transport, distribution and sales account for a greater share of the price paid by the end-user.

Lastly, it is also important to remark that the analysis above has been done without considering taxation and that any taxation of diesel will further improve the case for microgrid alternatives. Even with oil below 30 USD per barrel, renewable microgrids will be able to compete with diesel within the 5 years.

Overall, diesel will struggle to compete with renewable microgrid alternatives over the coming years. Any benefits from lower oil prices are likely to be temporary and offset by lower prices for energy storage and renewable generation assets as these technologies race to the bottom.